MUMBAI: Indians are shopping for smaller packs of consumer goods as rising prices of groceries and household supplies weigh on their budgets.

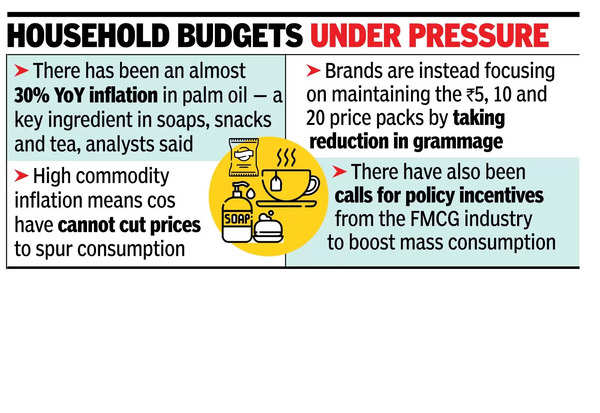

Categories like soaps, snacks and tea have been the most impacted by commodity inflation. There has been an almost 30% year-on-year inflation in palm oil – a key ingredient used in the aforementioned products, analysts at Nuvama Institutional Equities said in a note. “Due to price hikes, consumers are going for smaller packs (in these categories) which negatively impacts volume,” they said.

Hit by inflation, FMCG firms have taken price hikes in the Dec quarter. Companies like Hindustan Unilever (HUL), Godrej Consumer Products (GCPL) have taken nearly 10% price hikes in soaps while players like Bikaji and Tata Consumer have increased prices of their range of snacks and tea respectively. More price hikes are expected by some companies in the current quarter, analysts said. “We are in the process of taking one or two more price hikes and I think that should be enough,” Saugata Gupta, MD & CEO at Marico, told TOI in a recent interview.

Growth of FMCG firms has been sluggish due to weak urban demand even as rural markets have been growing on the back of good monsoons. The recovery, however, is gradual and cannot alone compensate for the urban slump. High commodity inflation means that companies have no room to reduce prices to spur consumption. “If consumers move from buying say a 1 kg pack of tea and multi-pack soaps to a 500 gram tea pack and one or two soaps, it will definitely impact quarterly volume growth of companies,” an analyst said.

Brands are focusing on maintaining the Rs 5, 10 and 20 price packs by taking reduction in grammage. “If shrinkflation hits hard, consumers are most likely to shift brands based on the value-for-money offered by alternative brand options,” independent consumer consultant Akshay D’Souza said.

There have been calls for policy incentives from some sections of the FMCG industry to boost mass consumption. Nestle has been impacted by inflation in green coffee, which it uses to make Nescafe. “…the price of green coffee has increased thrice in the last three years. We took several steps to identify savings across the value chain and find efficiencies that can counter the unprecedented green coffee cost increase, only after which we took a price hike,” a Nestle India spokesperson said.