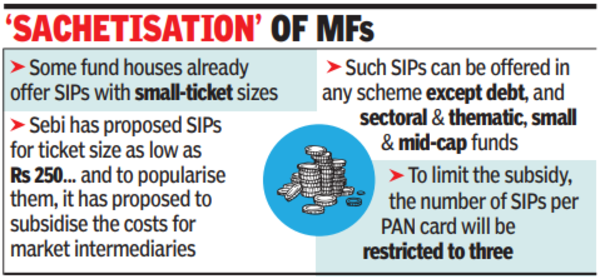

MUMBAI: Markets regulator Sebi on Wednesday proposed to launch monthly systematic investment plans (SIPs) for ticket size as low as Rs 250, aiming for wider financial inclusion. Calling this sachetisation of mutual funds, Sebi would partially subsidise the costs incurred by all the intermediaries for these small-ticket SIPs, it said in a consultation paper. To limit the amount of subsidy for these SIPs, the number of SIPs per PAN card will be limited to three, Sebi said in the consultation paper.

Sebi is proposing sachetisation of MF “to promote financial inclusion, inculcate the habit of systematic saving and facilitate investment of small savings by investors new to the MF space”. At present, some fund houses offer SIPs with small ticket sizes under some of their schemes.

Sebi plans to make it popular and hence has proposed to subsidise the costs for these types of schemes. Sebi will pay some subsidy to the intermediaries — including fund houses, clearing corporations, MF platforms, KRAs, and RTAs — which will help spread these SIPs.

Also See:Public Holidays

Sebi said small-ticket SIPs can be offered in any scheme except for debt schemes, sectoral and thematic schemes, small-cap and mid-cap funds under equity schemes category.

“Sachetisation of mutual funds will enable small-ticket investment in mutual funds gradually on a periodic basis. This can assist in financial empowerment of the under-served section of the economy and nudge fund houses to expand their footprints to even remote locations in the country,” the consultation paper said. “While the number of investors participating in mutual funds have grown steadily over the years, there is considerable opportunity for increasing the reach of the mutual funds to all sections of the society, to enable every individual to have access to this financial product.”

The consultation paper said that investors would be allowed to invest through up to three Rs 250 SIPs (one each in up to three fund houses). Fund houses are allowed to offer more Rs 250 but will not get any subsidy for those additional ones.

Sebi said it would pay an incentive of Rs 500 to distributors and the execution only platforms (EOPs) for getting investors to subscribe to small-ticket SIPs. The incentive should be over and above the distribution commission payable by the fund houses to the distributor, it said. Sebi expects the financial inclusion facilitated under this scheme would break-even for the AMCs within two years.

Sebi has sought comments from the public on its proposals by Feb 6. After that it would take the final decision on launching small-ticket SIPs.