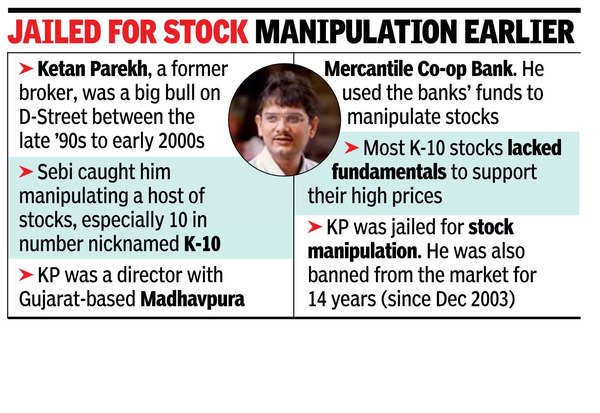

MUMBAI: Ketan Parekh, the infamous market operator who was once jailed for stock exchange-related manipulations, is in Sebi‘s net again.

The markets regulator has unearthed a front-running scheme in which Parekh (also nicknamed KP) was one of the main brains. Along with Rohit Salgaocar – a Singapore citizen of Indian origin – KP orchestrated a scheme to front-run the trades of a foreign fund for illegal gains, Sebi investigations found.

Although Parekh never put in any trades, his Kolkata-based associates carried out the operation. Sebi has barred KP, Salgaocar and 20 other entities from the market. They have also been ordered to pay back the illegal gains worth nearly Rs 66 crore.

Sebi investigations found that a large US-based assets manager had several of its funds registered with Sebi as foreign portfolio investors. This fund used to consult Salgaocar before placing their trades in India. Salgaocar also had referral arrangements with Motilal Oswal group and Nuvama for executing FPI trades for a commission.

As and when Salgaocar received orders from the US-based fund, he used to instruct dealers at Motilal Oswal and Nuvama for executing the trades. However, before he would communicate the orders to the two, he also passed on the same information to Parekh. KP, in turn, would pass on the information to his various conduits in Kolkata who would execute the trades that were based on inside information ahead of the genuine trades by the dealers at Motilal Oswal and Nuvama.

Sebi investigations found that Parekh used to regularly change his phone numbers. On their part, his conduits used various pseudonyms like ‘Jack’, ‘John’, ‘Boss’, ‘Bhai’, ‘Wellwisher’ to save KP’s numbers in their phones.

Parekh and Salgaocar also admitted to Sebi investigators that they had regularly interacted with each other. Investigations found that soon after their interactions, KP’s conduits got messages about trades that Salgaocar communicated to the traders at Motilal Oswal and Nuvama. Bank accounts of various entities have established links of fund flows between Parekh and several of his conduits too.

In its interim order, Sebi ordered impounding of illegal gains aggregating nearly Rs 66 crore from 22 entities including Parekh and Salgaocar. Sebi has also barred Parekh, Salgaocar and Ashok Kumar Poddar – one of Parekh’s Kolkata-based conduits – from the market till further order. The regulator has ordered a freezing of demat and bank accounts of all 22 entities. It also said they will not be able to redeem their mutual fund investments.

All these entities have been given 21 days to present their case with Sebi’s investigators.