MUMBAI: The country’s biggest lender as well as the largest private bank have started the new year with higher returns for some depositors.

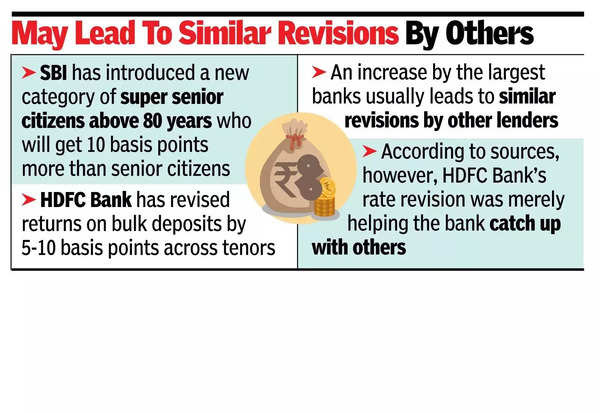

While SBI has introduced a new category of super senior citizens above 80 years – who will get 10 basis points more than senior citizens – HDFC Bank has revised returns on bulk deposits (Rs 5 crore and above) by 5-10 basis points across tenors.

SBI’s revision is part of a strategy to innovate on deposits to capture a larger share of savings. Besides offering higher returns for those aged 80 and above under its Patron deposits, the bank has structured schemes where customers can decide their savings goals, such as Rs 1 lakh, and sign up for recurring deposits accordingly.

The rate revision comes at a time when there is widespread demand for a rate cut by RBI to boost growth. Meanwhile, RBI data showed that bank deposits and bank credit were growing at the same pace of 11.5% as of mid-Dec.

An increase by the two largest banks usually leads to similar revisions by other lenders. However, sources said that HDFC Bank’s rate revision was merely helping the bank catch up with others. Higher deposit rates also translate into higher borrowing costs because of a revision in the marginal cost of lending rates, which are directly linked to the cost of deposits.

Bank of Baroda, the first major lender to announce business figures for the quarter ended Dec 2024, said its global advances and global deposits grew 11.7% and 11.8%, respectively.

SBI’s ‘Har Ghar Lakhpati’ – a pre-calculated recurring deposit scheme – is designed to help customers accumulate Rs 1 lakh or multiples thereof. This product simplifies the process of achieving financial goals, allowing customers to plan and save effectively. It is also available to minors, encouraging early financial planning and the development of a savings habit.

“We aim to create goal-oriented deposit products that not only enhance financial returns but also align with our customers’ aspirations. We are redefining traditional banking to make it more inclusive and impactful,” SBI chairman C S Setty said.

HDFC Bank offers 7.25% for non-seniors on its 55-month deposits. It offers 6.6% to 7% on deposits between one and five years.

SBI offers domestic term deposit rates with the highest interest rates under its “444 days” (Amrit Vrishti) scheme at a rate of 7.25%, effective from July 15, 2024. Senior citizens are offered an interest rate of 7.75%. The scheme is valid until March 31, 2025.

For regular deposits, the highest rate of 6.75% is offered to the general public, and 7.25% for senior citizens, on deposits with tenures between 3-5 years. Deposits for 5 years and up to 10 years also offer the same interest rates as 3-5 year deposits. For shorter tenures, SBI offers interest rates ranging from 3.5% to 6.5% for the general public and 4% to 7% for senior citizens, depending on the deposit period.