MUMBAI: RBI governor Sanjay Malhotra faces his first major challenge after taking office last month. The rupee is set to breach the 86 level this week as the dollar strengthens against most currencies. This will impede efforts to support GDP growth, which is expected to slow to 6.4 per cent in FY25, through lower interest rates.

“The rupee has continued to touch lifetime lows in each of the last few sessions. Pressure on the currency has stemmed from a stronger dollar and is further compounded by patchy FPI inflows. The pressure on the rupee is likely to persist in the near term as uncertainty over US rates and government policies is expected to keep the dollar strong,” said Aditi Gupta, economist at Bank of Baroda, in a report she co-authored.

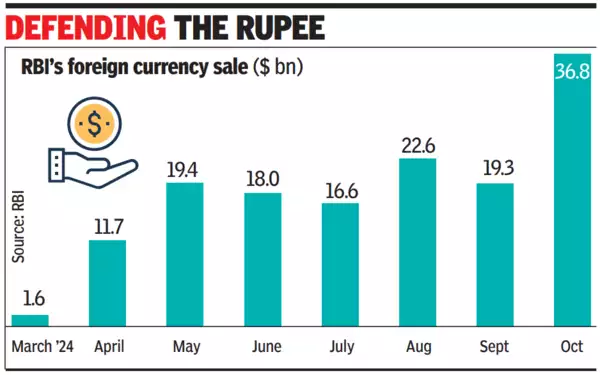

While RBI has been intervening in the forex market by selling dollars in the spot and forward markets (see graphic), the collateral damage has been the draining of liquidity, resulting in an increase in overnight interest rates.

US Treasuries plunged on Friday after data showed the labour market grew in Dec, sending the 30-year bond yield above 5 per cent for the first time in more than a year. This added to the recent selloff in global bonds as investors grow anxious over lingering inflation and widening fiscal deficits, including in the US, as President-elect Donald Trump returns to the White House.

According to a Stanchart report co-authored by Anubhuti Sahay, the timeline for a 50 basis points repo rate cut has been revised to April-June from February-April due to tight rupee liquidity conditions.

Stanchart expects a 50 basis points cash reserve ratio (CRR) cut at the Feb MPC meeting, citing expectations of a further widening in the liquidity deficit. Estimates suggest that the headline liquidity deficit could increase to Rs 1.9-2.5 lakh crore by the end of FY25 if left unaddressed.

The report also lowers its dollar-rupee forecast by 175 paise to 86.25 by March 2025, attributing the change to RBI’s increased tolerance for a stronger dollar and weaker balance of payments flows.

“The magnitude of FX intervention since October has been substantial and is resulting in adverse effects, such as tighter banking liquidity and higher short-term rates at a time of weakening growth, which in turn is leading to more capital outflows and possibly dollar hoarding in anticipation of further depreciation,” said Sonal Varma and Aurodeep Nandi of Nomura in a report. According to them, allowing some depreciation would be a prudent move.

The Oct policy report said that the baseline assumptions for projections, assumed the rupee at 83.5 versus the dollar in the second half of FY25. “If the rupee depreciates by 5 per cent over the baseline, inflation could be higher by around 35bps while GDP growth could edge up by around 25bps through short term stimulation of exports,” RBI said.