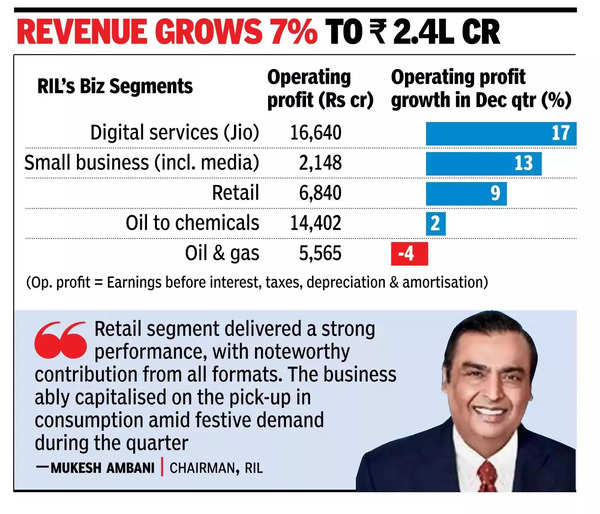

MUMBAI: Reliance Industries, India’s largest company in terms of market value, reported a 12% rise in quarterly profit on Thursday, helped by strong demand in the retail business, and as higher telecom tariffs and a rise in 5G subscribers boosted the telecom unit. Profit grew to Rs 21,930 crore in the Dec quarter, beating analysts’ estimates. Revenue totalled over Rs 2.4 lakh crore, up about 7%.

Saif Ali Khan Health Update

Operating profit, a yardstick for underlying business performance, increased about 8% to Rs 45,595 crore. Expenses climbed by 7% to nearly Rs 2.1 lakh crore. Operating profit of the traditional oil-to-chemicals (O2C) business increased 2% to Rs 14,402 crore due to higher volumes and operational flexibility.

Operating profit of the digital services business (Jio) rose 17% to Rs 16,640 crore due to higher subscriber numbers, and hike in telecom tariffs. Jio’s average revenue per user (ARPU) – a key metric that influences income – was at Rs 203 in Q3FY25 up 12%. ARPU is the total revenue of the telecom operator divided by the number of users on its network. Launched in 2016, Jio had 482 million customers as on Dec 31, 2024 and saw data and voice traffic growth of 22% and 7% on its network, respectively.

Operating profit of the retail business shot up by 9% to Rs 6,840 crore due to operational efficiencies. Increased customer engagement during the festive period through new product launches and promotions also boosted the division. The business also witnessed a turnaround in the fashion and lifestyle consumption basket during the quarter. The grocery business under JioMart, Signature Fresh, Smart Bazaar and 7-Eleven, grew by 37%.Reliance Retail had 19,102 outlets as on Dec 31, 2024.

O2C showcased its “innate resilience, registering growth even in this prolonged period of volatility in the global energy markets”, said Reliance chairman and MD Mukesh Ambani. He said that robust growth in digital services was “led by sustained subscriber addition”, with an increasing number of users upgrading to 5G networks. While the retail business “ably capitalised on the pick-up in consumption amid festive demand during the quarter”.

Operating profit of the oil & gas business declined 4% to Rs 5,565 crore due to lower revenues. RIL’s net debt at the end of Q3FY25 was Rs 1.15 lakh crore, and it had Rs 2.34 lakh crore in cash and cash equivalents. The company spent Rs 32,259 crore towards capital expenditure during the quarter.