Haldiram Snacks Food in big demand! PepsiCo has recently joined the race to acquire a stake in Haldiram Snacks Food, following Temasek and Alpha Wave Global, who have already submitted formal proposals last month. These bidders are currently engaged in detailed discussions with the Aggarwal family, seeking to purchase a 10-15% stake in India’s premier ethnic snacks and convenience foods manufacturer.

Senior executives from PepsiCo’s New York headquarters have recently initiated preliminary discussions with the Aggarwal family members regarding a potential minority stake acquisition.

According to an ET report, these discussions remain in early stages and may not necessarily result in a deal. The US parent company will spearhead any potential investment, with the Indian division playing a relatively minor role in the process.

The Aggarwal family is seeking their first external investor, with expectations of a company valuation between Rs 85,000-90,000 crore.

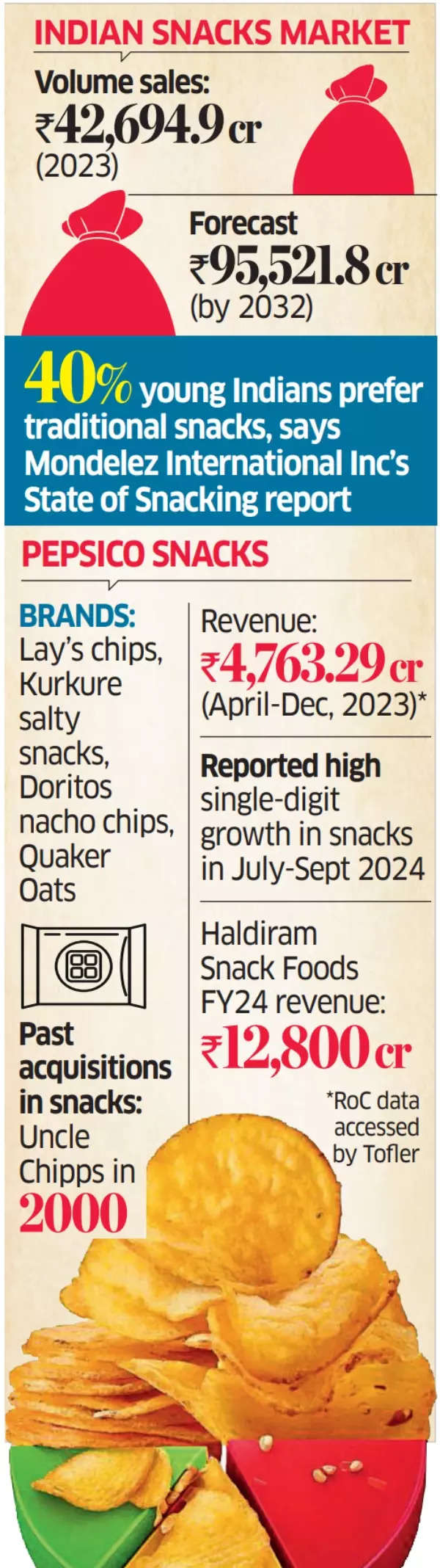

Indian Snacks Market

PepsiCo, which produces Lay’s chips, Kurkure salty snacks and Doritos nacho chips, currently faces strong competition in India’s snacks sector.

The market has witnessed significant growth in regional and direct-to-consumer snack manufacturers. The ethnic snacks segment, while dominated by major players like Haldiram, Bikanerwala, Balaji, and listed entities such as Bikaji Foods, Gopal Snacks and Prataap Snacks, remains highly fragmented with numerous regional competitors. These local manufacturers typically offer products at lower prices, maintain direct distribution networks, and provide higher profit margins to retailers.

RJ Corp-owned Varun Beverages Ltd (VBL) manages the majority of PepsiCo’s beverages operations, including Pepsi, Mountain Dew, 7Up, Slice and Tropicana. “With beverages bottling outsourced to VBL, PepsiCo India‘s core focus is snacks, a market where it is no longer as dominant as it used to be,” said an executive.

In western snacks like chips and nachos, PepsiCo maintains a 24% market share leadership. However, it has limited presence in traditional Indian snacks such as namkeen, bhujiya, and chana chur. The organisation sees potential growth through collaboration with Haldiram, with both snacks and beverage divisions being comparable in size.

The company’s current India leader, Jagrut Kotecha, was selected specifically for his extensive experience in PepsiCo’s snacks division, aiming to strengthen the snacks business nationally.

According to Registrar of Companies (RoC) data accessed via Tofler, PepsiCo India Holdings recorded consolidated revenue of Rs 5,954.16 crore from April to December 2023. During this period, its snacks division, comprising Kurkure, Lays, Doritos and Quaker, generated Rs 4,763.29 crore.

Haldiram Snack Foods achieved revenue of Rs 12,800 crore in FY24, substantially exceeding PepsiCo’s figures. The company produces and sells 500 varieties of snacks, namkeen, sweets, ready to eat and pre-mixed food items.

PepsiCo’s acquisition history includes Uncle Chipps from Amrit Agro Ltd in 2000, when its snacks division operated as Frito Lay. Uncle Chipps now serves primarily tier 2 and 3 markets as a value brand. The company launched Doritos nachos, its multi-billion brand, in 2016-17 within the western snacks category.

Industry analysts suggest Haldiram would likely prefer selling completely rather than accepting a minority investment from PepsiCo. Previous discussions with Mondelez, Kellogg’s and Tata Consumer ended without agreement. Earlier negotiations with former PepsiCo CEO Indra Nooyi also proved unsuccessful.