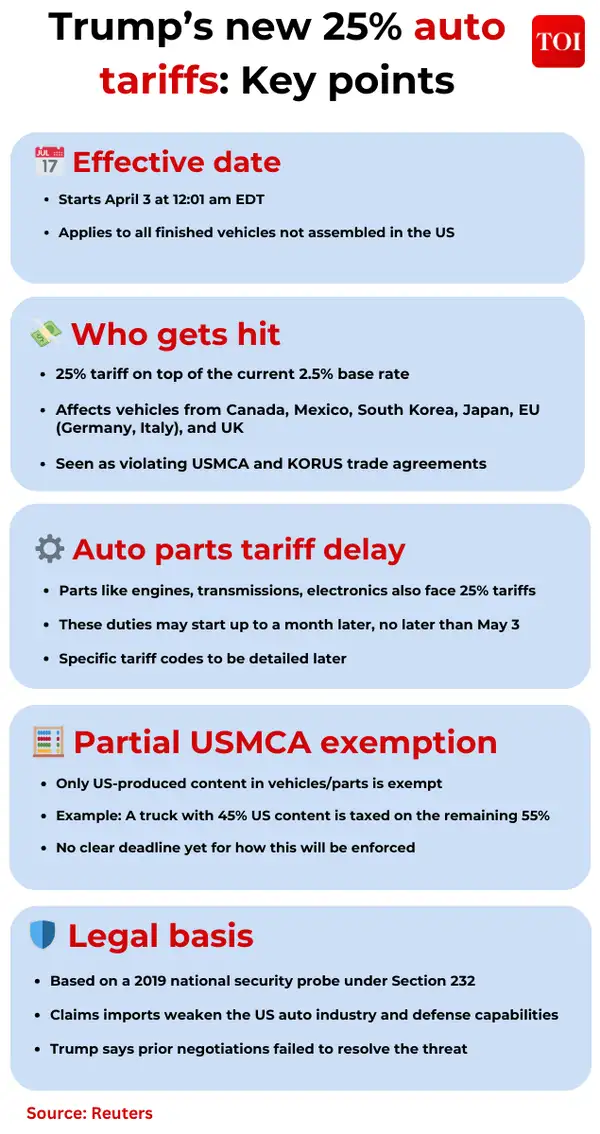

US President Donald Trump has declared a 25% tariff on imported cars and key auto parts, effective April 3. The policy is framed as a strategy to revive the US automotive manufacturing industry by incentivizing domestic investment from automakers.

The tariff encompasses not just fully assembled vehicles but also critical components such as engines, transmissions, powertrain systems, and electrical assemblies. According to the White House, the measure is expected to yield around $100 billion annually, reflecting a notable pivot in US trade policy.

What it means for India

India’s direct automobile exports to the US remain relatively small compared to Mexico, Canada, and Japan. However, the secondary effects of the US tariffs may have significant implications for India’s automotive sector. In particular, India’s auto components industry—deeply embedded in global supply chains—has emerged as a key supplier to American car manufacturers.

According to reports, India exported approximately $1.5 billion in auto parts to the US in 2023. The new tariffs could cause major disruptions, increasing input costs for US-based automakers and thereby reducing demand for Indian parts. Suppliers may face pressure on profit margins and be forced to absorb added costs or redirect exports to other regions.

Tata Motors, vulnerable to trade disruptions given its substantial exports of Jaguar Land Rover vehicles to the US, was notably impacted. The shares of Tata Motors were down over 5% on Thursday.

Also read: Trump announces 25% tariffs on imported cars: Musk’s Tesla takes a hit, but could still win

Zoom in

- India’s leading car manufacturers like Tata Motors and

Maruti Suzuki focus predominantly on domestic sales, which offers some insulation from the direct effects of the tariffs. However, global players with links to India may encounter more complex risks. - Tata Motors’ subsidiary, Jaguar Land Rover (JLR), exports luxury vehicles mainly from the UK and Europe to the US. The new tariffs could drive up costs, prompting JLR to reevaluate its pricing models, consider relocating production, or face margin pressure in an already tight luxury segment.

- Meanwhile, India’s fast-growing auto parts sector is likely to feel the impact most immediately. Large Indian suppliers such as Bharat Forge and Motherson Sumi may need to rethink their global strategies. Exploring new markets in Europe, Southeast Asia, or Africa could become essential to maintain resilience and enable long-term growth.

- Auto component manufacturers in India face greater potential consequences compared to vehicle makers due to US President Donald Trump’s tariff policies, according to industry experts. “It is the Indian auto components industry that is more likely to face the heat due to the US tariff as exports from here to the US are significant. “Indian vehicle makers are less likely to be impacted as there are no direct exports of fully built cars from India to the US,” an industry executive told PTI.

- However, Global Trade Research Initiative has said that the tariffs are likely to have minimal effects on India’s automotive sector. According to GTRI, whilst the tariffs have created anxiety amongst worldwide automobile producers, India’s restricted presence in the U.S. automotive sector indicates negligible consequences. The statement said “While the announcement sent ripples through global automotive markets, its implications for India’s auto industry remain limited–and may, in fact, present an opportunity for Indian exporters”.

Between the lines

- The new tariff announcement reflects Trump’s broader policy of reciprocal tariffs, especially targeting countries with high import duties on US goods. India’s elevated tariffs—some exceeding 100% on imported vehicles—have been a previous point of contention for Trump.

- Should the US expand retaliatory measures beyond automobiles to sectors like pharmaceuticals, agriculture, or technology, the resulting trade friction could intensify. Estimates suggest India could lose up to $7 billion annually if broader tariffs are imposed across multiple sectors.

What they’re saying

- Industry reactions have been swift and sharply divided over the economic implications of the tariffs.

- Jennifer Safavian, CEO of Autos Drive America, warned, “The tariffs imposed today will make it more expensive to produce and sell cars in the United States, ultimately leading to higher prices, fewer options for consumers, and fewer manufacturing jobs in the US.”

- Tesla CEO

Elon Musk underscored the universal impact on manufacturers, stating, “It’s important to note that Tesla is NOT unscathed here. The tariff impact on Tesla is still significant.” - In contrast, the United Auto Workers (UAW), representing American factory workers, praised Trump’s move, highlighting potential job gains domestically. UAW President Shawn Fain said, “With these tariffs, thousands of good-paying blue-collar auto jobs could be brought back to working-class communities across the United States within months.”

The big picture

Trump’s tariff policy has broad implications for the global automotive landscape. Countries heavily involved in US automotive supply chains—including Canada, Mexico, Germany, Japan, and South Korea—could see their production and trade flows disrupted. The result may be a deceleration in global economic activity.

For India, the scenario presents both challenges and openings. While direct exposure to US tariffs is limited, knock-on effects through supply chains and shifting market dynamics are likely. Indian suppliers reliant on the US must adapt quickly, whether by pivoting to other markets or strengthening their domestic footprint.

What’s next

- A US trade delegation led by assistant trade representative for South and Central Asia Brendan Lynch in in India for a round of discussions from March 25 to 29.

- The talks are part of broader efforts to finalize a bilateral trade agreement (BTA). The timing is critical, as the US prepares to impose reciprocal tariffs on countries including India starting April 2.

- Indian exporters remain cautious, particularly in sectors like pharmaceuticals and agriculture that may be exposed to further tariff hikes.

- The current negotiations aim to improve market access, lower trade barriers, and increase supply chain collaboration between the two nations.

- India and the US are targeting completion of the first phase of the BTA by autumn 2025, with a shared goal of expanding bilateral trade to $500 billion by 2030. India has expressed openness to reducing tariffs on certain US products in return for favorable trade terms.

(With inputs from agencies)