MUMBAI: Mobile phone purchases have become a key channel for individuals in the informal sector to get into the formal credit system. While the Jan Dhan Yojana provided everyone with bank accounts, availability of mobile phones on EMI is providing them with a credit history, opening the doors for other loans.

“The key channels for the entry of new-to-credit (NTC) borrowers are consumption-led loans such as mobile phone purchases and purchase of two-wheelers. Mobile purchases have emerged as a dominant channel because everyone needs a phone. This trend is supported by tie-ups between mobile phone manufacturers who have access to the device,” said Bhavesh Jain, MD & CEO of TransUnion Cibil. However, the current year has seen a moderation in adding new-to-credit customers.

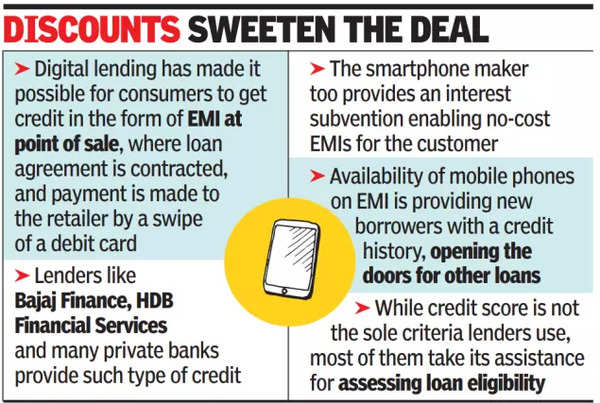

In recent years, digital lending has made it possible for consumers to get credit in the form of EMI at point of sale, where the loan agreement is contracted, and payment made to the retailer by a swipe of the debit card. Lenders like Bajaj Finance, HDB Financial Services and many private banks provide this credit. Sometimes the OEM provides an interest subvention enabling no-cost EMIs for the customer. The no-cost EMI has resulted in majority of smartphone sales taking place on credit. In some cases, lenders pass on some of the interest subvention to the customer offering better pricing.

Availing a loan, however small, makes it easier to get loans in the future because it generates a credit score. This score is calculated as a combination of factors like credit exposure, utilization, inquiry trend, payment behaviour, current and historical delinquencies, and account status. While the Cibil score is not the sole criteria lenders use, most of them take its assistance for assessing loan eligibility.

According to Jain, enrolling new-to-credit borrowers works for lenders because, besides expanding the market, it is also a good strategy for customer loyalty. “Our data shows that over 40% of first-time borrowers return to the same creditor for a second loan in the future,” said Jain.