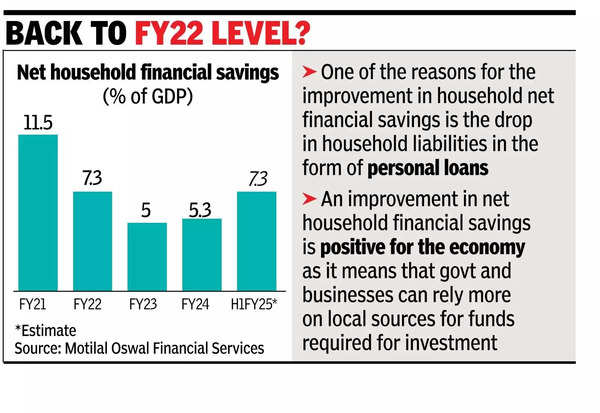

MUMBAI: Net household financial savings, which improved to 5.3% of GDP in FY24 from a 47-year low of 5% in FY23, are likely to have rebounded sharply in the first half of FY25, early indicators showed. An improvement in net household financial savings is positive for the economy as it means that govt and businesses can rely more on local sources for funds required for investment.

The country’s net financial savings had peaked at 51.7% of GDP during Covid but declined during to 36.1% in FY22 and 28.5% in FY23. The country’s financial savings represents the combined savings of all sectors in the economy: households, corporates (private and public), and govt. One of the reasons for the improvement in household net financial savings is the drop in household liabilities in the form of personal loans. RBI’s crackdown on unsecured personal loans, gold loans and lending to NBFCs has resulted in a slower pace of growth in these segments.

RBI published updated data on FY24 household net financial savings in its Dec 2024 bulletin, revealing a marginal increase to 5.3% of GDP in FY24, compared to 5% in FY23 and 7.3% and 11.5% in FY22 and FY21 respectively.

According to a Motilal Oswal Financial Services report, estimates suggest that net household financial savings grew to 7.3% of GDP in the first half of FY25, almost double the level of the first half of FY24. This improvement was primarily due to a decrease in liabilities, which dropped to 4.7% of GDP from 6.9% in H1 FY24, alongside an increase in gross financial savings.

Although gross financial savings rose to 11.6% of GDP in FY24, higher liabilities offset the gains, leading to a modest rise in net household financial savings to 5.3%. Household liabilities reached 6.4% of GDP, a 17-year high, just below the record of 6.6% in FY07.

The rise in gross financial savings is attributed to insurance savings, lower currency holdings, and stronger capital market investments. Household debt, however, also increased to 41% of GDP in FY24 from 37.9% in FY23. The report estimates that household debt rose slightly to 43.5% of GDP in the first half of FY25, up from 31-32% in previous years.

While housing loans account for around 30% of total household debt, non-housing debt has risen significantly, reaching 32.3% of GDP in the second quarter of FY25.