NEW DELHI: You won’t have to worry about overindulging with this one! Low-alcohol and no-alcohol beers are steadily gaining traction as Gen Z and millennial consumers, along with a growing focus on health, drive a dramatic shift in the beer market.

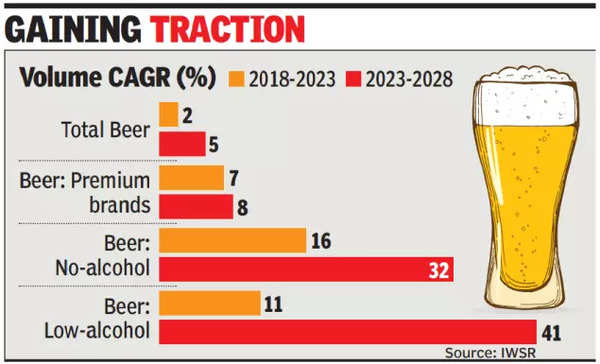

While the numbers remain small, with only a few companies currently leading the charge, industry watchers say the category is gaining traction and is expected to become significant in the coming years. As moderation increasingly becomes a key consumer preference, more brands are expected to innovate and tap into this trend to meet the rising demand. Globally too, the trend towards moderation is taking centre-stage, with no-alcohol brands gaining significant momentum.

“There is a steady rise in demand for alcohol-free/low-alcohol beers, more evident in metros and large cities where there is a greater consciousness against drinking and driving. Both premiumisation and no-zero alcohol are running hand in hand. The numbers (of alcohol free/ low alcohol beer) are small at present in India, but the growth rates are good. Consumers want low or no alcohol beer but without compromising on the distinctive taste of beer. The trend is pushing companies to innovate with technology and develop products that deliver the same taste with or without alcohol,” Brewers Association of India director general Vinod Giri told TOI.

At present, key brands in the segment include: Budweiser 0.0, Bavaria, Heineken 0.0 and Coolberg.

Vikram Bahl, CMO, United Breweries, the maker of Heineken and Kingfisher, says: “We continue to grow in the non-alcoholic segment. The trend of moderation is small in India at present, while it’s becoming significant globally. We will continue to invest in our offerings, including Heineken 0.0”.

Mirroring the premiumisation trend, the beer market in India witnessed around 6.5% volume and 7.4% value growth in 2024, Giri added. Premium beers are growing at more than double the rate of overall beer sales, which are expanding at a healthy single-digit pace. Additionally, flavours are popular among Gen Z and younger consumers, with the segment anticipated to see significant growth.

According to the International Wine and Spirits Record (IWSR), the global beverage alcohol market is expected to begin its recovery in 2025, following declines in 2023 and continued challenges in 2024. India, China and the US will be key value growth drivers, adding $30 billion in incremental value by 2028. Strong growth across no-alcohol categories has continued throughout 2024