MUMBAI: All roads lead to hinterlands for FMCG companies as consumption in rural India has been growing faster than in urban in recent quarters, helped in parts by bountiful monsoons which boosted household incomes.

Fast-moving consumer goods companies are widening their rural distribution network, launching affordable pack sizes and pushing low unit packs of premium products to cater to rural consumers who seek better choices.

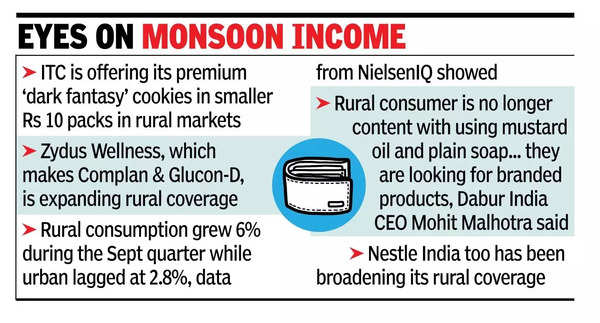

ITC, for instance, is offering its premium dark fantasy cookies in smaller Rs 10 packs in rural markets where consumption of biscuits and snacks, an otherwise urban centric category is growing. “We are offering a wide-range of our food portfolio in the rural market including our premium range at specific unit points to drive consumption-led growth,” Shuvadip Banerjee, chief digital marketing officer at ITC told TOI.

Zydus Wellness, which makes products like Complan and Glucon-D, is focusing on expanding its rural coverage where penetration of brands has always trailed urban and there is room for growth, said CEO Tarun Arora.

Besides, the strategy will be to push more of Rs 10 and Rs 15 price packs in the markets where there is an increasing demand for such packs. “For our talcum powder, Rs 10 packs have played an important role in growth. Aspirations of rural consumers match that of urban. It’s just that rural households tend to buy more accessible lower unit pack,” said Arora.

Due to high commodity inflation, offering Rs 5 price packs in general have become unsustainable in many categories. “Although inflation has impacted all price points, the sweet spot in low unit packs is moving towards Rs 10 category in my opinion,” said Arora. Rs 50 and Rs 100 price packs are the other segments that tend to do well in rural markets, said industry executives.

Rural consumption of FMCG products grew at more than double the pace of urban in the Sept quarter where the middle class have curtailed spending due to high food inflation. Rural consumption grew 6% during the quarter while urban lagged at 2.8%, data released by NielsenIQ had showed. “The agriculture industry is expected to grow and govt’s continued focus on rural development will help the rural shopper. Therefore, we do see a sustained rural performance despite inflation continuing at least in the first half of 2025,” analysts at Kantar said.