Mumbai: C S Setty, who took over as SBI chairman in August 28, is positioning the country’s largest bank as an entity focused on delivering quality service to customers by preparing the state-owned lender to harness technology. While upbeat on the economy, Setty tells TOI that the Budget should focus on pushing private sector capex. Excerpts:

How would you position SBI, given that private banks are achieving scale?

SBI is a 218-year-old institution, but we constantly reinvent ourselves to stay relevant. We began with rural financing, which remains a mainstay, but we have also expanded into corporate and retail banking. This showcases SBI’s agility in adapting and readjusting to market dynamics. Over the last decade, we have embraced technology and digitalisation. Despite our extensive physical presence, we are now the largest digital bank in India.

How do you plan to improve these channels?

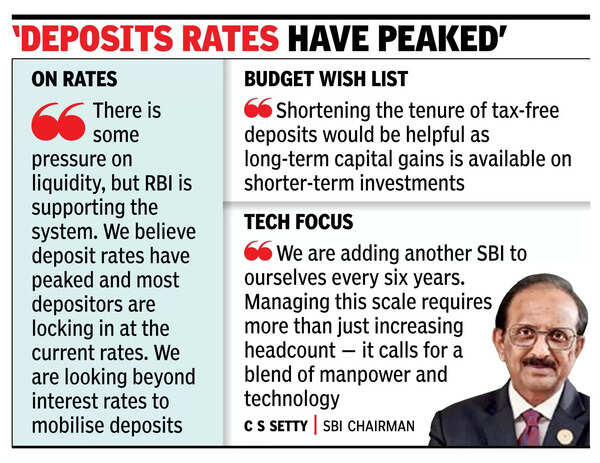

We are adding another SBI to ourselves every six years. Managing this scale requires more than just increasing headcount – it calls for a blend of manpower and technology. We are strengthening all our channels, including ‘feet on the street’. A large number of employees are dedicated to home and auto loan procurement. In addition, we are actively recruiting; we will hire 13,000 clerical staff.

In the previous quarter, did you notice any slowdown? What is the outlook for the next quarter?

Any slowdown we observed is seasonal, not structural. Govt spending was subdued in the last two quarters, but we anticipate resilience in the economy. Our house view is for approximately 6.5% growth.

A recent finmin report mentioned RBI’s macro-prudential regulations contributed to the slowdown. What’s SBI’s view on these segments?

The segments impacted by RBI’s measures have slowed down. However, SBI benefits from being a diversified bank. If one segment slows, we pivot to others. Sectors like MSME, and agriculture are performing well and remain vital to the economy.

What’your Budget wishlist?

The Budget should focus on spurring economic activity and boosting private capital expenditure. Shortening the tenure of tax-free deposits would be helpful as long-term capital gains is available on shorter-term investments.

There’s exuberance in the home loan market. Has this made you cautious?

Around 99% of our home loan borrowers are first-time homebuyers rather than speculative investors. This is reflected in our strong asset quality. We didn’t see significant defaults, even during Covid. The market remains predominantly owner-occupied, with vast untapped potential.

Do you have visibility on gold loan use?

Gold loans are primarily used for short-term cash management by small businesses and SME customers, though some are for consumption purposes. We also have a significant agri-gold loan portfolio, which is very low-risk. We maintain visibility over how these loans are used and repaid, ensuring moderate loan-to-value ratios.

There were concerns about credit card rollovers and rising NPAs in the card business…

Most credit card defaults, similar to microfinance institutions, occur in small-value loans. These borrowers are often new to credit and lack financial literacy. They sometimes borrow from multiple lenders. RBI’s mandate for more frequent credit history updates will help address this issue. We already have access to borrowing information across lenders, and these updates will now be refreshed fortnightly instead of monthly.

The Budget mentioned that banks should develop own models for MSME credit. Are you ready?

Yes, we have already implemented a business rule engine that is data- and cash-flow-driven. It uses GST data, account details, and sales figures to assess creditworthiness. Loans up to Rs 5 crore receive in-principle approval within 15 minutes. We plan to extend this facility to loans of up to Rs 50 crore as well.

How is the liquidity situation? You had said deposit rates have peaked.

There is some pressure on liquidity, but RBI is supporting the system. We believe deposit rates have peaked, and most depositors are locking in at the current rates. We are looking beyond interest rates to mobilise deposits.

Banks are facing competition from products like MFs. What is your strategy to maintain FD flow and attract salary accounts?

Diversification of investment portfolios is a natural progression in a maturing economy. However, bank deposits remain essential. We aim to enhance customer stickiness by offering innovative products that combine recurring deposits, fixed deposits, and SIPs. Contrary to popular belief, we have a significant youth customer base, and our digital offerings are highly competitive.

Are you comfortable lending to large projects given the uncertainty about infra project norms?

SBI has always been a major player in project financing in India. We possess the expertise to appraise large projects and remain a preferred lender in this space.