NEW DELHI: In a season of making annual declarations on investments and deduction, the income tax department has put employees and employers on notice after it came across lakhs of instances of individuals making bogus claims related to donations to political parties and charitable organisations as well as false investment and interest payment claims.

It all goes back to searches and surveys conducted by the tax department in the last few years, which showed individuals claiming deductions for donations to unrecognised political parties that enjoy certain tax exemptions.

Saif Ali Khan Health Update

Authorities found several instances of money being returned to the donors. In a large number of cases, it was found that actual donations were not made.

90k incorrect deduction claims withdrawn till 2024

“For political donations, there is no third-party verification, and individuals have been taking a chance, expecting they would not be caught. We have seen instances of employees of some companies indulging in fraudulent claims like these, there are thousands of such cases ,” said a tax officer.

A deeper analysis revealed that there were instances of bogus donations even to charities with some individuals claiming interest payment on loans for higher education when no loan had even been taken. There have also been cases where PAN numbers of individuals have been shared to claim tax free house rent allowance when no property has even been taken on rent.

From investments (section 80C of the I-T Act) to health insurance premiums (section 80D), education loans (80E), specified charities (80G), political parties and electoral trusts (80GGB and 80 GGC) violations were observed, prompting a standard operating procedure being developed by the investigation wing to develop a standard operating procedure and approach employees and employers and individuals to revise their tax returns, or face action.

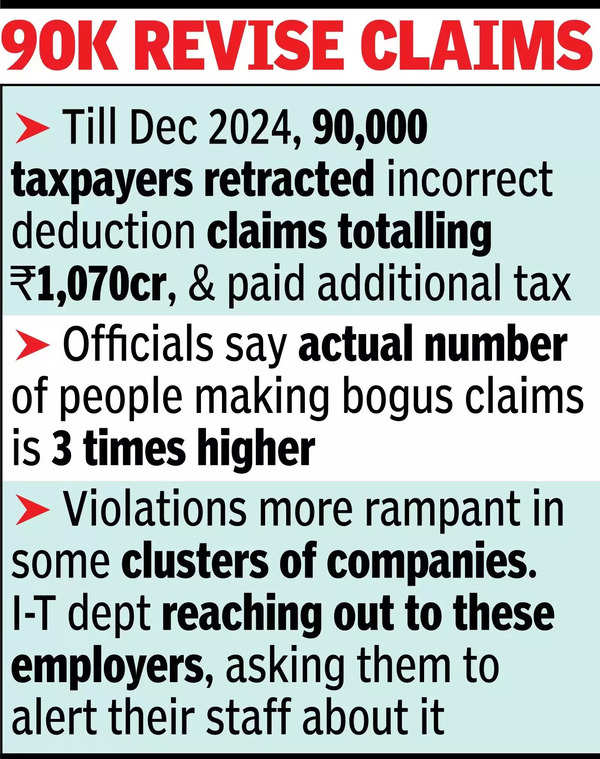

Till Dec 2024, around 90,000 taxpayers have withdrawn incorrect deduction claims, which add up to Rs 1,070 crores, and have also paid additional taxes.

Officials said the actual cases are nearly three times higher than the number of returns that have been updated and a drive is being launched to focus on employers to educate their employees, especially when there are certain clusters of companies where such violations are more rampant.