MUMBAI: Unclaimed amounts with life insurers stood at nearly Rs 22,237 crore at the start of FY24. A six-month drive from June-November 2023 helped reduce unclaimed amounts by a little over Rs 1,018 crore, according to Irdai. The initiative highlighted the need for policyholders bequeathing benefits to non-relatives to undertake proper estate planning, as insurers remain cautious about registering nominees who are not immediate family members.

Insurers have been directed to update contact, bank, and nominee details regularly, conduct KYC and Re-KYC, use credit bureaus and media to trace consumers, and hold agents accountable for accurate information. Despite these measures, unclaimed funds often arise because nominees are non-traceable due to a lack of awareness, changes in family situations, or instances where the nominees are no longer alive.

“This is a problem that needs to be solved as an industry,” Sujeet Kothare, executive VP (marketing) at Tata AIA, said. The insurer is actively reaching out to nominees to keep them informed about policy details, benefits, and any changes over the policy term. It is also offering discounted HPV vaccinations to nominees to promote cancer prevention. “The Tatas have historically taken a stand against cancer,” he said.

Kothare noted challenges when policyholders do not have immediate family members or choose non-relatives as nominees. “Having a non-relative as a nominee creates a moral hazard, but there are exceptions allowed when there are no blood relatives,” he said. He suggested creating a trust and nominating the trustee to ensure smooth execution of such bequests.

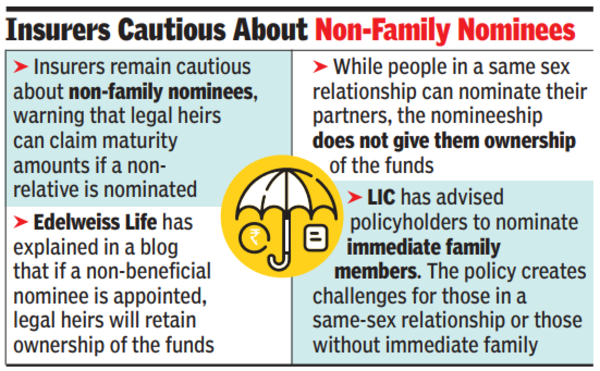

Edelweiss Life, in a blog, explains that if a non-beneficial nominee is appointed, legal heirs will retain ownership of the funds. It cited an example: “If A appoints C, his girlfriend, as a nominee, C can receive the money but must hand it over to A’s legal heirs, such as his spouse or children.” While people in a same sex relationship can nominate their partners, the nomineeship does not give them ownership of the funds.

LIC has also advised policyholders to nominate immediate family members, stating that “nomination in favour of a stranger cannot be made as there is no insurable interest, and moral hazard may be involved.” This policy creates challenges for individuals in same-sex relationships or those without immediate family members.